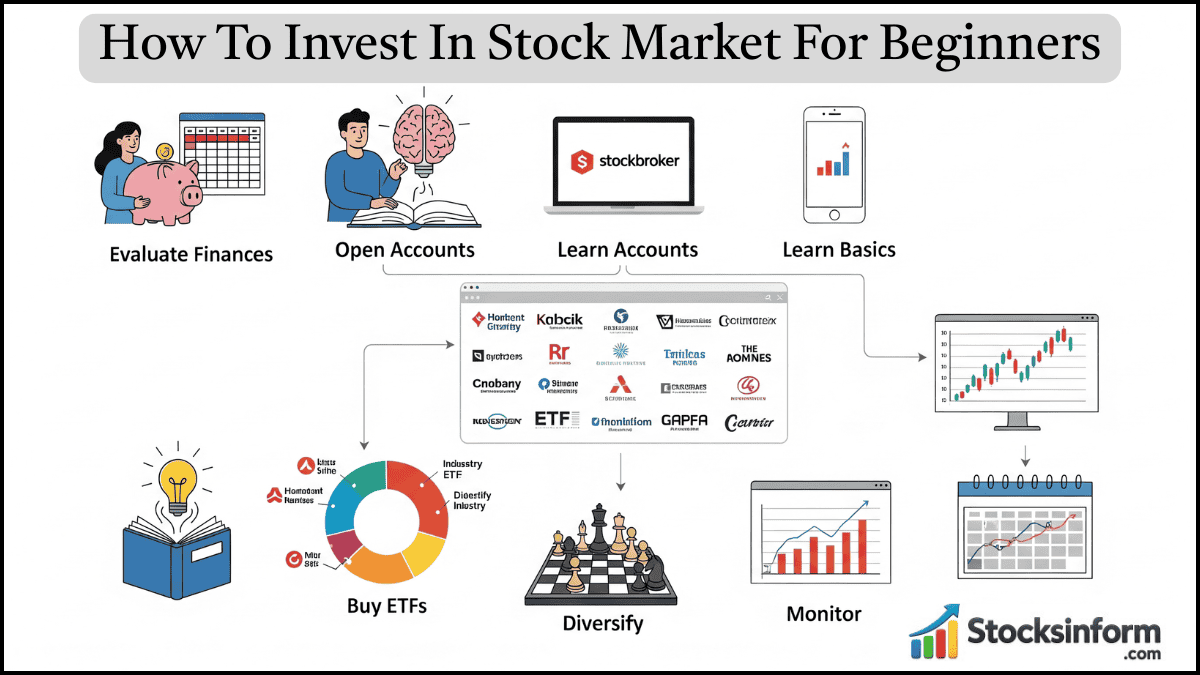

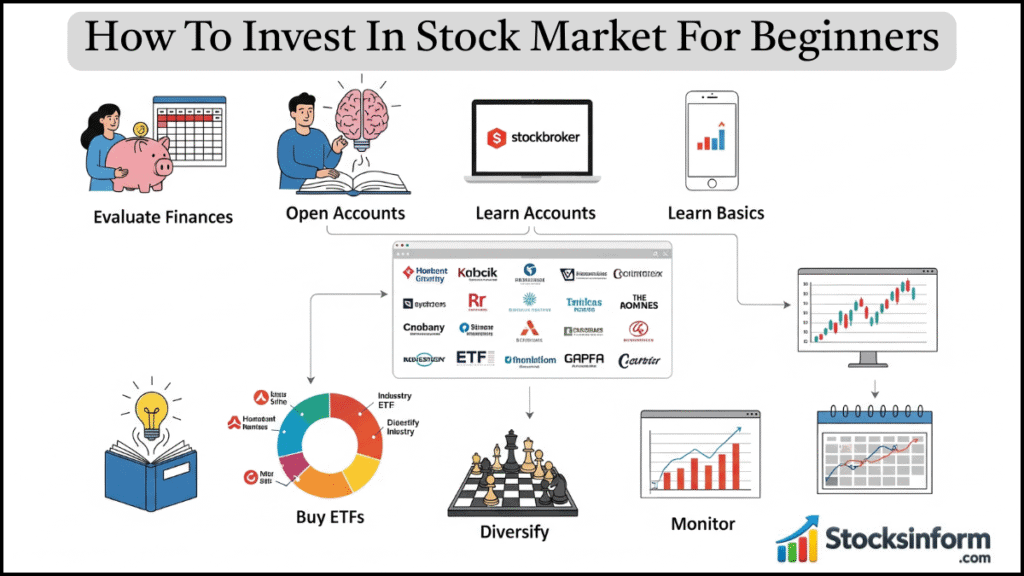

Learn How To invest In stock market for beginners with 10 simple steps. Start building wealth today—set a budget, open accounts, diversify, and avoid pitfalls!

How To Invest In Stock Market For Beginners: Your 10-Step Starter Guide

Feeling overwhelmed by the stock market? You’re not alone. Over 55% of Americans own stocks, yet many beginners hesitate, fearing complexity or losses. The truth? Investing isn’t reserved for Wall Street experts. With the right strategy, anyone can grow wealth over time.

This comprehensive guide breaks down how to invest in stock market for beginners into 10 actionable steps, turning confusion into confidence and setting you on a path to financial growth. We’ll cover everything from financial readiness to choosing the right investments and avoiding common pitfalls.

Step 1: Evaluate Your Finances

Before buying a single stock, it’s crucial to have a clear understanding of your current financial situation. This foundational step ensures you’re investing responsibly and not putting your essential needs at risk.

1. Set Your Investment Budget:

Determine how much money you can realistically allocate to investments each month or quarter. This should be discretionary income – funds you won’t need for immediate expenses or within the next 5+ years. A good starting point for many beginners, particularly in India, is to aim for ₹500–₹2,000 per month. The key is consistency, even if the amount is small initially. As your income grows, you can gradually increase this allocation.

2. Establish a Robust Emergency Fund First:

This is non-negotiable. Before you invest in the stock market, you must have an emergency fund saved up in a readily accessible, liquid account (like a savings account or a short-term fixed deposit). This fund should cover 3–6 months’ worth of your essential living expenses (rent/mortgage, utilities, food, transportation, etc.).

Stocks are inherently volatile; their value can fluctuate significantly. You should never invest money that you might need for an unexpected expense, like a job loss, medical emergency, or car repair. Investing your “rent money” is a recipe for disaster and forced selling at a loss.

Pro Tip: Implement the 50/30/20 rule for budgeting your income. Allocate 50% of your take-home pay to “needs” (housing, food, utilities), 30% to “wants” (entertainment, dining out, hobbies), and dedicate 20% to “savings and investments” (which includes building your emergency fund and then your stock market investments). This simple rule provides a balanced framework for managing your money.

Step 2: Learn Share Market Basics

Stock market investing for beginners requires a fundamental understanding of key terminology and concepts. Don’t feel pressured to become an expert overnight, but grasp these basics to make informed decisions.

1. Stocks (Equities):

When you buy a stock, you are purchasing a small slice, or a fractional ownership, of a publicly traded company. For example, buying Reliance shares means you own a tiny part of Reliance Industries Ltd., and your investment’s value will fluctuate based on the company’s performance, market sentiment, and broader economic factors. Owning stock gives you a claim on the company’s assets and earnings, and potentially voting rights in some cases.

2. Indices (Benchmarks):

An index is a statistical measure that tracks the performance of a group of stocks representing a specific market or segment. In India, the Nifty 50 tracks the performance of the 50 largest and most liquid Indian companies listed on the National Stock Exchange (NSE), while the BSE Sensex tracks 30 prominent companies on the Bombay Stock Exchange (BSE). In the U.S., the S&P 500 tracks 500 large U.S. companies. These indices serve as benchmarks to gauge the overall health and direction of the market.

3. Market Orders:

This is a common type of order you place with your broker. A market order is an instruction to buy or sell a stock immediately at the best available current price. While simple, it’s important to be aware that the price might change slightly between the time you place the order and when it’s executed, especially in fast-moving markets. Other order types (like limit orders) allow you to specify the exact price you want to buy or sell at, offering more control but with the risk that your order might not be filled.

Resource: For a deeper dive into these and other essential terms, check out Investopedia’s Stock Basics Guide. It’s an excellent, comprehensive resource for understanding financial concepts.

Step 3: Choose a Broker & Open Accounts

Choosing the right broker is a critical step, as they are your essential gateway to the stock market. Your broker will facilitate all your transactions and hold your investments.

1. Choose a Broker Wisely:

Research different brokerage firms to find one that suits your needs. Consider factors like:

- i) Fees and Commissions: Look for brokers with low or zero brokerage fees, especially for equity delivery trades. Many Indian brokers like Zerodha, Upstox, and Groww offer competitive pricing.

- ii) Platform User-friendliness: Is their trading platform intuitive and easy to navigate for a beginner?

- iii) Research and Educational Resources: Do they offer tools, reports, and learning materials to help you make informed decisions?

- iv) Customer Service: How responsive and helpful is their support?

- v) Regulatory Compliance: Ensure the broker is regulated by relevant authorities (e.g., SEBI in India).

2. Open a Demat Account:

In India, a Demat (dematerialized) account is mandatory to hold your shares in an electronic format. Think of it as a digital locker for your securities. When you buy shares, they are credited to your Demat account, and when you sell, they are debited. Major Depository Participants (DPs) like CDSL and NSDL hold these accounts.

3. Open a Trading Account:

This account is linked to your Demat account and is used to place buy and sell orders in the stock market. When you place a buy order, funds are debited from your linked bank account to your trading account, and then the shares are credited to your Demat account. Conversely, when you sell, shares are debited from your Demat account, and funds are credited to your trading account and then to your bank.

4. Understand Account Types:

Beyond the basic Demat and Trading accounts, it’s useful to be aware of different account types, especially if you plan to invest globally or for specific tax advantages. For instance, in the U.S., tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s offer tax benefits for long-term savings.

While India has its own tax structures for capital gains, the core Demat and Trading accounts are fundamental for direct equity investing. Research tax implications of your investments in your specific country.

Step 4: Practice Risk-Free with a Simulator

Before you commit your hard-earned money, gaining practical experience without financial risk is invaluable. This is where stock market simulators (also known as paper trading or virtual trading platforms) come in.

1. Practice with an Online Stock Simulator:

These platforms mimic real-time market conditions using live data, but you trade with virtual money. This allows you to place buy and sell orders, build a hypothetical portfolio, and track its performance as if you were investing real funds.

2. Test Strategies Without Financial Risk:

A simulator is the perfect sandbox for testing different investment strategies. You can experiment with various asset allocations, try buying specific stocks or ETFs, and observe how they perform over days, weeks, or even months.

This hands-on experience will help you understand market dynamics, how your chosen assets react to news, and the emotional aspects of seeing your portfolio fluctuate, all without the stress of losing actual money.

Popular platforms for virtual trading include TradingView (with its paper trading feature) and Moneybhai (specifically for the Indian market). Some brokers also offer their own simulated trading environments.

Step 5: Build Your Strategy

Entering the stock market without a clear strategy is like sailing without a map. For beginners, the most robust and recommended strategy is focusing on long-term investment.

1. Focus on Long-Term Investment:

The stock market has historically rewarded patient investors over extended periods (typically 5 years or more). This approach, often called “buy and hold,” involves investing in quality assets and holding them through market ups and downs, allowing them to grow over time through compounding. Long-term investing minimizes the impact of short-term volatility and often results in better tax treatment for capital gains. Avoid the allure of “get-rich-quick” schemes or hot tips.

2. Avoid Short-Term Trading:

Day trading (buying and selling stocks within the same day) or swing trading (holding stocks for a few days or weeks) is extremely challenging and risky, especially for beginners. It requires deep market knowledge, advanced technical analysis skills, precise timing, and significant capital. Statistics consistently show that a vast majority of retail day traders (often cited as 90% or more) lose money in the long run.

A CNBC Report highlighted the persistent challenges faced by day traders. Focus on wealth creation, not speculative gambling.

3. Consider DIY Investing (Do-It-Yourself):

While financial advisors have their place, many beginners can successfully manage their own investment portfolios, especially with the rise of user-friendly platforms and accessible information.

The legendary investor Warren Buffett famously advised that for most individuals, simply investing in a low-cost S&P 500 index fund (or a Nifty 50 index fund in India) and holding it long-term will outperform a vast majority of actively managed funds. This principle suggests that simple, low-cost DIY investing can be incredibly effective over time, beating even professional fund managers in many cases.

Step 6: Start Investing—The Smart Way

Once your finances are in order and you understand the basics, it’s time to make your first investment. For beginners, it’s crucial to start with lower-risk, diversified options.

1. Consider Investing in Funds First:

i) ETFs (Exchange-Traded Funds):

These are ideal for beginners. An ETF is a basket of securities (like stocks, bonds, or commodities) that trades on an exchange, much like an individual stock. When you buy one unit of an ETF, you gain exposure to dozens, hundreds, or even thousands of underlying assets.

For example, buying a Nippon India Nifty 50 ETF gives you instant diversification across the top 50 Indian companies. ETFs offer low expense ratios, liquidity, and immediate diversification, significantly reducing the risk associated with investing in a single company.

ii) Mutual Funds:

These are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of securities. While generally actively managed (though passive index mutual funds exist), they allow experts to make investment decisions on your behalf. They are a good option if you prefer a hands-off approach and are willing to pay a slightly higher expense ratio compared to ETFs for professional management.

2. Avoid Individual Stocks Initially:

While the allure of picking the next big stock is strong, individual stocks are inherently high-risk. The performance of a single company can be unpredictable, and if that company faces challenges, your entire investment could be significantly impacted. Beginners lack the experience and research capabilities to properly evaluate individual company fundamentals and market trends. Start with diversified funds to mitigate this risk.

3. Introduce Blue-Chip Stocks Later:

Once you have gained some experience and have a well-diversified core portfolio through ETFs or mutual funds, you can gradually consider adding a small allocation to “blue-chip” stocks. These are shares of large, well-established, financially sound companies with a long history of stable earnings and reliable performance. Examples include companies like HDFC Bank, Reliance Industries, or TCS in India, or global giants like Apple, Microsoft, or Johnson & Johnson. These companies are generally more resilient during market downturns, but still carry individual stock risk.

Step 7: Diversify Your Portfolio

Diversification is one of the most critical principles in investing. It’s about “not putting all your eggs in one basket” to reduce risk.

1. Spread Investments Across Multiple Categories:

i) Asset Classes:

Don’t invest solely in stocks. Consider diversifying across different asset classes like stocks (equities) for growth, bonds (debt) for stability and income, and gold or other commodities for inflation protection and safe-haven properties. For instance, a common beginner’s portfolio might be 70% stocks and 30% bonds, adjusted based on age and risk tolerance.

ii) Sectors:

Within stocks, diversify across various economic sectors. Don’t put all your money into technology stocks, even if they’re performing well. Spread your investments across sectors like healthcare, finance, consumer goods, energy, and industrials. This way, if one sector experiences a downturn, others might remain stable or even grow, cushioning the impact on your overall portfolio.

iii) Geographies:

Look beyond your home country’s market. Investing in global ETFs or international funds can provide exposure to different economies and reduce reliance on a single market’s performance. For instance, investing in U.S. or emerging markets alongside Indian equities can offer broader diversification.

2. Stat:

A study by Vanguard, a leading investment management company, has highlighted that diversified portfolios tend to recover significantly faster in market downturns, often 3x faster, compared to concentrated portfolios. This underscores the power of diversification in protecting your wealth during volatile periods and enhancing long-term returns.

Step 8: Monitor and Manage Your Portfolio

Once you’ve invested, your job isn’t done. However, “monitoring” doesn’t mean obsessive daily checking.

1. Monitor Your Portfolio Quarterly:

Avoid the temptation to check your portfolio value daily. Market fluctuations are normal, and reacting to every minor dip or rise often leads to poor decisions. Instead, review your portfolio’s performance and composition quarterly. This gives you enough time to observe trends without getting caught up in short-term noise.

2. Rebalance Annually:

Over time, different parts of your portfolio will perform differently, causing your original asset allocation to drift. For example, if your stocks perform exceptionally well, they might grow to represent a larger percentage of your portfolio than you initially intended. Rebalancing means adjusting your portfolio back to your target asset allocation (e.g., if you aimed for 70% stocks, 30% bonds, and stocks grew to 80%, you’d sell some stocks and buy more bonds to return to 70/30). This process, typically done once a year, helps you manage risk and ensures you’re not overly exposed to any single asset class.

3. Utilize Investment Tracking Apps:

Many financial apps can help you monitor your portfolio easily. In India, apps like ETMoney and Groww provide dashboards to track your investments, analyze performance, and offer insights. These tools can help you stay organized and make informed decisions during your annual reviews.

Step 9: Avoid Common Beginner Traps

The stock market is rife with psychological pitfalls that can lead beginners astray. Being aware of these can help you avoid costly mistakes.

1. The 7% Rule Myth:

There’s a common misconception, sometimes misquoted as the “7% rule,” suggesting a fixed safe withdrawal rate from a retirement portfolio. The reality is far more complex. While a historical average return might be considered, a universal “safe” withdrawal rate simply doesn’t exist. It depends heavily on individual factors like your age, financial goals, portfolio size, current market conditions, and personal risk tolerance.

Historically, financial planners have often suggested a 3-4% initial withdrawal rate, adjusted for inflation, as a more sustainable figure for long-term retirement income. Relying on a fixed, high percentage can lead to running out of money, especially during market downturns.

2. FOMO (Fear of Missing Out):

This is a powerful psychological bias. When a particular stock or sector is skyrocketing, there’s an intense urge to jump in to avoid missing out on potential gains. This often leads to buying at the peak, just before a correction. Ignore the hype, celebrity endorsements, or social media trends. Stick to your well-thought-out investment plan and diversification strategy. Remember, successful long-term investing is about patience and discipline, not chasing fleeting trends.

Step 10: Keep Learning!

The investment landscape is constantly evolving. Continuous learning is essential to becoming a more confident and effective investor.

1. Learn Fundamental Analysis:

This method involves evaluating a company’s intrinsic value by examining its financial statements, management, industry, and economic conditions. Key metrics include:

i) P/E Ratio (Price-to-Earnings Ratio):

Compares a company’s share price to its per-share earnings, helping determine if a stock is overvalued or undervalued relative to its earnings.

ii) Debt-to-Equity Ratio:

Indicates the proportion of debt a company uses to finance its assets relative to the value of shareholders’ equity, signaling financial risk.

iii) Revenue Growth, Profit Margins, Cash Flow:

These metrics provide insights into a company’s operational health and ability to generate profits. Understanding fundamental analysis helps you select strong companies with solid financial foundations.

2. Learn Technical Analysis:

This method involves evaluating investments by analyzing statistical trends gathered from trading activity, such as price movement and volume. Technical analysts study price charts, patterns (like head and shoulders, double tops/bottoms), and indicators (like moving averages, Relative Strength Index – RSI) to identify potential entry and exit points for trades. While more associated with short-term trading, understanding basic chart patterns can provide context even for long-term investors.

Conclusion: Start Small, Think Big!

How to invest in the stock market for beginners boils down to a few core principles: patience, continuous education, and consistent investing. Don’t be intimidated by the perceived complexity. The most important step is to simply begin. Open your Demat account this week, commit to investing a small, manageable amount like ₹500 in a diversified ETF monthly, and let the powerful force of compounding work its magic over the years. Remember: Every seasoned investor was once a beginner, taking their first cautious steps. Your financial future starts today.

Ready to begin your investment journey? Sign up for a free Groww Demat account and claim your first free trade to start building your wealth!

FAQ: How To Invest In Stock Market For Beginners

Q1: How to start investing in the stock market as a beginner?

The best way to start is by first building an emergency fund and setting a budget for investments. Then, open a Demat and trading account with a reputable broker. Dedicate time to learn fundamental stock market basics and investment concepts. Begin by investing in low-cost, diversified Exchange-Traded Funds (ETFs) or index mutual funds, and commit to investing regularly through a Systematic Investment Plan (SIP) or similar method. Focus on long-term growth rather than short-term gains.

Q2: Can I invest ₹10 in the share market?

Yes, technically you can. While traditional stock purchases require buying full shares which can cost hundreds or thousands of rupees, many modern brokerage apps and platforms, particularly in the U.S. and increasingly in India (like Groww for certain stocks and ETFs), offer fractional shares. This means you can buy a small portion of a share, allowing you to invest as little as ₹10, ₹100, or any small amount you wish, gaining exposure to companies that might otherwise be out of your budget.

Q3: What is the 7% rule in stocks?

The “7% rule” is a misconception, often misinterpreted from historical average market returns or rules of thumb related to retirement withdrawals. There is no universal “7% rule” that guarantees a safe withdrawal or return. Historically, the U.S. stock market (S&P 500) has averaged around 10% annual returns before inflation, but this includes significant volatility. For retirement planning, the concept of a “safe withdrawal rate” is more complex. Many financial experts suggest a starting withdrawal rate of 3-4% of your portfolio value in the first year of retirement, adjusted for inflation in subsequent years, is a more realistic and sustainable figure to ensure your money lasts.

Q4: How much should I invest in stocks for the first time?

For your very first investment, it’s wise to start small and incrementally increase your contributions as you gain confidence and understanding. A practical starting point for many beginners, especially in India, is to commit ₹500–₹2,000 per month. The most crucial aspect is to never invest money that you might need in the short term (within the next 5 years) or money that is part of your emergency fund. Consistency and regular investing (even small amounts) are more important than the initial lump sum.

Q5: What is the best stock to invest in for beginners?

For beginners, the “best” investment is typically not an individual stock due to higher risk. Instead, it’s highly recommended to start with Blue-Chip ETFs (Exchange-Traded Funds) or index mutual funds that track broad market indices. For example, in India, an ETF tracking the Nifty 50 (like Motilal Oswal Nifty 50 ETF) offers instant diversification across the top 50 Indian companies. Once you have a diversified base, you can gradually consider stable, large-cap “blue-chip” stocks like TCS, HDFC Bank, Infosys, or Reliance, which have a long history of financial stability and consistent performance.

Q6: How much to invest in the stock market for beginners?

After establishing a solid emergency fund (3-6 months of expenses), aim to allocate 10–15% of your net income towards investments, including the stock market. This is a general guideline, and the ideal amount will depend on your individual financial goals, income, expenses, and risk tolerance. The key is to make investing a regular habit and gradually increase your investment amount as your income grows and your financial situation becomes more stable.

Q7: Is Trading 212 safe?

Yes, Trading 212 is generally considered safe. It is a legitimate and regulated brokerage firm. Specifically, it is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Supervision Commission (FSC) in Bulgaria. Regulation by reputable financial authorities provides a significant layer of investor protection, ensuring the broker adheres to strict operational and financial standards. However, as with any financial platform, it’s always prudent to do your own research, read reviews, and understand their terms and conditions before committing your funds.