Explore the Top 10 Telecom Stocks in India for 2025, including Bharti Airtel, Indus Towers, and more. Discover why investing in India’s telecom sector, fueled by 5G and government initiatives, offers lucrative opportunities for growth.

Introduction

India’s telecom sector is experiencing a transformative phase, fueled by the rapid rollout of 5G technology, soaring data consumption, and robust government initiatives like the National Broadband Mission. With a subscriber base exceeding 1.2 billion, India ranks as the world’s second-largest telecom market (IBEF). The sector’s market size is estimated at USD 53.18 billion in 2025, with projections to reach USD 83.34 billion by 2030, growing at a CAGR of 9.4% (Mordor Intelligence). This growth presents a golden opportunity for investors looking to tap into the top 10 telecom stocks in India.

In this comprehensive guide, we’ll explore the list of telecom stocks in India, focusing on the top 10 based on market capitalization. We’ll dive into each company’s profile, recent developments, and why they’re considered leaders in the industry. Whether you’re a seasoned investor or a beginner, this post will help you navigate the top 10 telecom stocks in India NSE and make informed investment decisions.

Why Invest in Telecom Stocks?

The telecom sector is a cornerstone of India’s digital economy, contributing approximately 6% to the nation’s GDP (New Indian Express). Here’s why investing in telecom stocks is appealing:

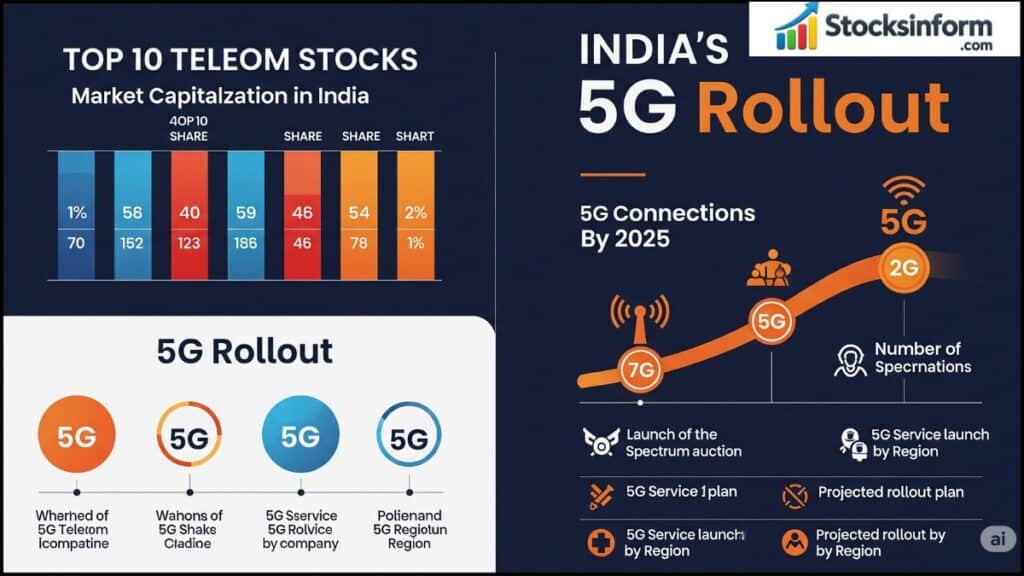

- 5G Revolution: India’s 5G rollout, one of the fastest globally, reached 738 districts by December 2023, with 100 million 5G connections (Drishti IAS). This creates new revenue streams for telecom companies.

- Government Support: Initiatives like the National Broadband Mission aim to provide high-speed internet to all villages by 2024, while the Union Budget 2025-26 allocated ₹81,005.24 crore (US$ 9.27 billion) to telecom and IT (IBEF).

- Rising Demand: With nearly 1 billion internet users expected by 2025, the demand for mobile data and broadband services is skyrocketing (Invest India).

Investing in telecom stocks offers exposure to a sector driving India’s digital transformation, making it a promising avenue for long-term growth.

Methodology for Selecting Top Telecom Stocks

To compile the list of telecom stocks in India, we’ve prioritized market capitalization, a key indicator of a company’s size and market influence. We’ve also considered financial metrics like price-to-earnings (P/E) ratio, return on equity (RoE), and recent performance trends. The data is sourced from reputable platforms like Equitymaster, ensuring accuracy and reliability.

Top 10 Telecom Stocks in India NSE

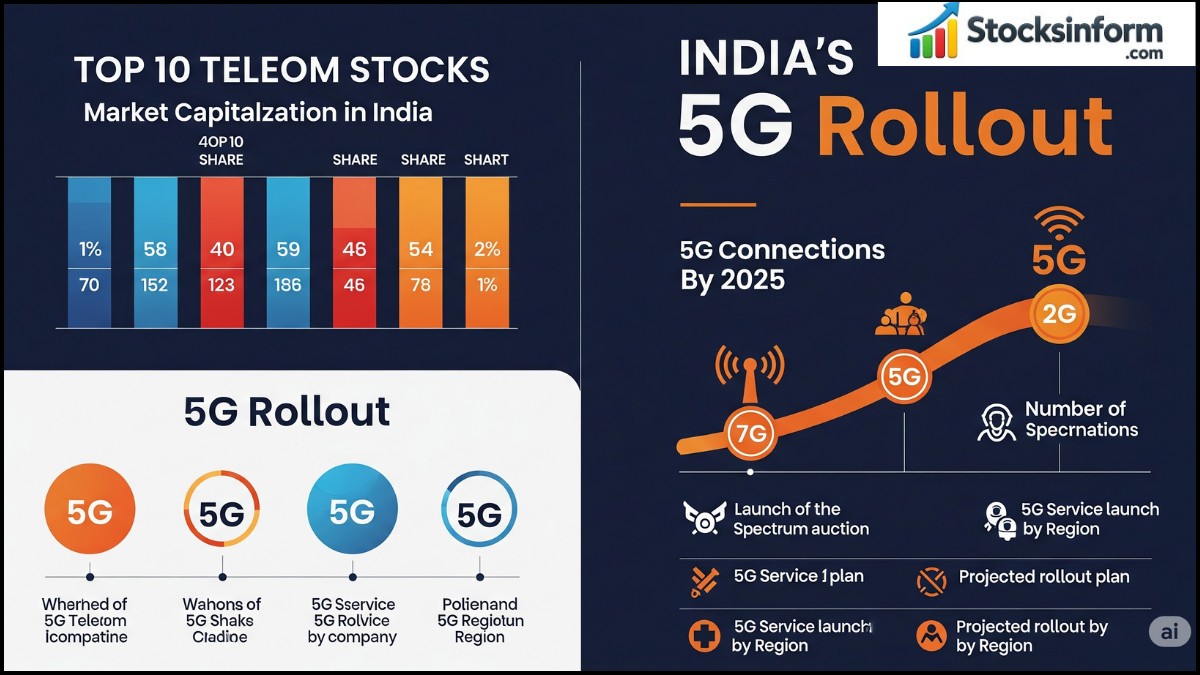

Below is the list of top 10 telecom stocks in India for 2025, ranked by market capitalization:

1. Bharti Airtel

- Market Cap: ₹12,358,820 million

- Description: Bharti Airtel is a leading telecom operator, providing mobile, broadband, and digital TV services across India and several African and South Asian countries.

- Recent Developments: Airtel is aggressively expanding its 5G network, aiming for nationwide coverage by 2025. In 2024, it overtook competitors in wireless broadband subscriber additions (Mordor Intelligence).

- Why It’s a Top Stock: Airtel’s robust subscriber base and leadership in 5G make it a cornerstone of the telecom sector.

2. Indus Towers

- Market Cap: ₹1,087,978 million

- Description: Indus Towers is India’s largest provider of passive telecom infrastructure, managing a vast network of tower sites.

- Recent Developments: The company is capitalizing on 5G infrastructure demand, securing contracts with major operators.

- Why It’s a Top Stock: Its critical role in supporting 5G rollout ensures steady revenue growth.

3. Bharti Hexacom Ltd.

- Market Cap: ₹985,900 million

- Description: A subsidiary of Bharti Airtel, Bharti Hexacom operates in the Rajasthan telecom circle, offering mobile and broadband services.

- Recent Developments: The company is expanding its 4G and 5G networks in Rajasthan to enhance connectivity.

- Why It’s a Top Stock: Its regional focus and synergy with Airtel’s broader strategy make it a strong investment.

4. Tata Communications

- Market Cap: ₹478,458 million

- Description: Tata Communications provides global digital infrastructure, including data centers, cloud, and security solutions.

- Recent Developments: The company is investing heavily in data center expansion to meet growing cloud service demand.

- Why It’s a Top Stock: Its diversified portfolio and global presence offer stability and growth potential.

5. RailTel Corporation of India

- Market Cap: ₹137,378 million

- Description: RailTel is a neutral telecom infrastructure provider, leveraging its optic fiber network along railway tracks.

- Recent Developments: RailTel has secured contracts under the BharatNet project to provide broadband in rural areas.

- Why It’s a Top Stock: Its alignment with government initiatives ensures long-term growth.

6. HFCL

- Market Cap: ₹125,426 million

- Description: HFCL manufactures telecom equipment, specializing in optical fiber, wireless, and broadband technologies.

- Recent Developments: The company has won multiple orders for 5G equipment, boosting its manufacturing capabilities.

- Why It’s a Top Stock: HFCL’s focus on 5G and indigenous production aligns with India’s self-reliance goals.

7. AGC Networks

- Market Cap: ₹84,574 million

- Description: AGC Networks offers telecom solutions, including managed services, network integration, and cybersecurity.

- Recent Developments: The company is expanding its enterprise-focused ICT solutions.

- Why It’s a Top Stock: Its diversified offerings cater to the growing enterprise market.

8. Optiemus Infracom

- Market Cap: ₹55,925 million

- Description: Optiemus Infracom distributes mobile handsets and provides telecom infrastructure services.

- Recent Developments: The company is diversifying into drone manufacturing, expanding its revenue streams.

- Why It’s a Top Stock: Its innovative approach and telecom expertise make it a unique player.

9. SAR Televenture Ltd.

- Market Cap: ₹12,528 million

- Description: SAR Televenture provides telecom infrastructure, focusing on tower services.

- Recent Developments: The company is expanding its tower portfolio to support 5G deployments.

- Why It’s a Top Stock: Its niche focus on infrastructure supports the sector’s growth.

10. ADC India Communications

- Market Cap: ₹6,118 million

- Description: ADC India Communications provides telecom solutions, including voice, data, and managed services.

- Recent Developments: The company is enhancing its enterprise service offerings.

- Why It’s a Top Stock: Its focus on enterprise solutions ensures steady demand.

| Company | Market Cap (₹m) | P/E Ratio | RoE (%) | Sales CAGR (3 yrs, %) |

|---|---|---|---|---|

| Bharti Airtel | 12,358,820 | 36.6 | 10.5 | 14.2 |

| Indus Towers | 1,087,978 | 11.0 | 22.3 | 27.0 |

| Bharti Hexacom Ltd. | 985,900 | 66.0 | 10.9 | 15.5 |

| Tata Communications | 478,458 | 31.2 | 53.0 | 11.4 |

| RailTel Corp of India | 137,378 | 45.8 | 13.5 | 23.1 |

| HFCL | 125,426 | 72.5 | 8.5 | 0.3 |

| AGC Networks | 84,574 | 41.4 | 28.7 | 10.4 |

| Optiemus Infracom | 55,925 | 93.2 | 13.3 | 103.4 |

| SAR Televenture Ltd. | 12,528 | NM | 21.8 | 415.3 |

| ADC India Comm. | 6,118 | 25.0 | 29.2 | 44.0 |

Source: Equitymaster

Factors to Consider Before Investing

Investing in the top 10 telecom stocks in India NSE requires careful consideration of several factors:

- Financial Health: Evaluate metrics like P/E ratio, RoE, and debt-to-equity ratio to assess stability. For example, Indus Towers has a low P/E ratio of 11.0, indicating potential undervaluation.

- Competitive Landscape: The telecom sector is highly competitive, with major players like Airtel and Jio dominating. Smaller players may face challenges.

- Regulatory Environment: High spectrum costs and regulatory changes can impact profitability (New Indian Express).

- Technological Advancements: Companies investing in 5G, IoT, and digital services are likely to outperform.

Conclusion

The top 10 telecom stocks in India for 2025, led by Bharti Airtel and Indus Towers, offer investors a chance to capitalize on the sector’s growth. With 5G transforming connectivity and government initiatives driving digital inclusion, these stocks are well-positioned for long-term success. However, investors should conduct thorough research, assess financial metrics, and consider market risks before investing.

Ready to invest in the future of connectivity? Start exploring these top 10 telecom stocks in India NSE today and consult a financial advisor to build a diversified portfolio.

FAQ

1.Which telecom share is best?

The “best” telecom share depends on your investment goals and risk tolerance. Bharti Airtel and Indus Towers are strong contenders due to their market leadership and 5G focus. Always analyze financials and consult a financial advisor.

2. What are 5 good stocks in India?

Beyond telecom, some top stocks across sectors include:

Reliance Industries (Diversified)

Tata Consultancy Services (IT)

HDFC Bank (Banking)

Infosys (IT)

ICICI Bank (Banking)

Within telecom, Bharti Airtel, Indus Towers, Bharti Hexacom, Tata Communications, and RailTel are notable.

3. Which mobile company is listed in NSE?

Mobile companies listed on the NSE include Bharti Airtel, Vodafone Idea, Tata Communications, and Reliance Industries (via Jio).

4. Is it good to invest in telecom?

Investing in telecom can be rewarding due to 5G growth and increasing data demand. However, high debt and regulatory challenges require careful consideration. Diversification and research are key.