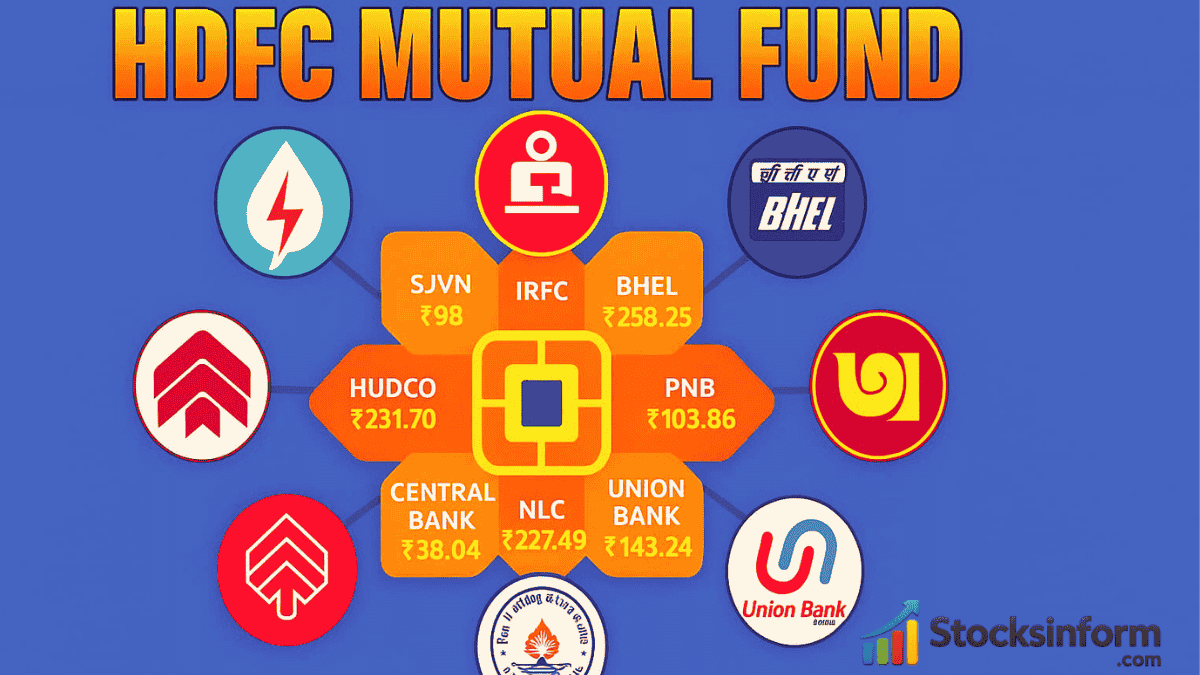

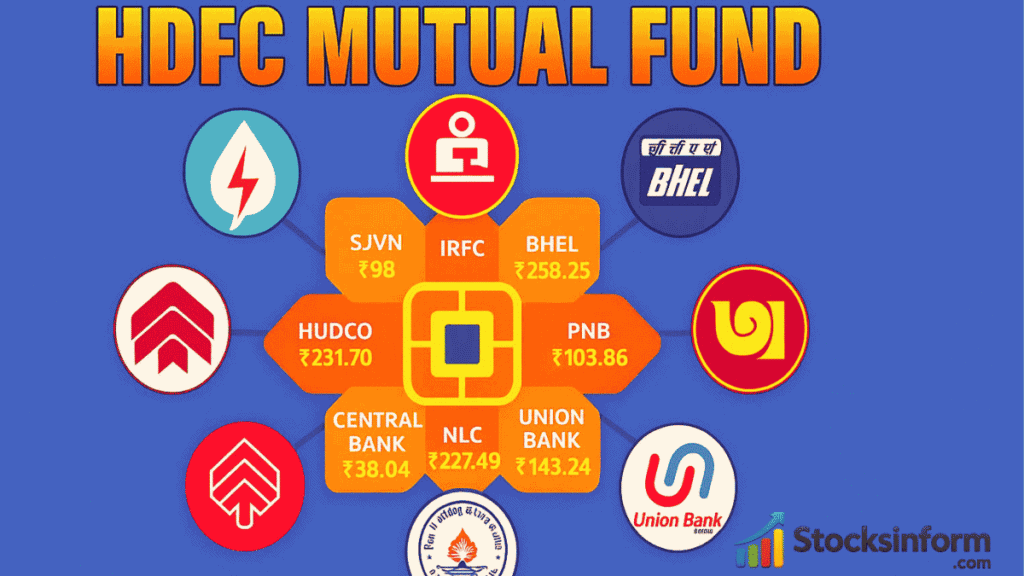

Discover the top 8 stocks owned by HDFC Mutual Fund. Uncover the potential of these incredible picks, primarily Public Sector Undertakings (PSUs), and see how HDFC Mutual Fund strategically invests for incredible growth. Learn about BHEL, HUDCO, NLC, Union Bank, IRFC, PNB, SJVN, and Central Bank. Invest wisely!

Introduction: Decoding HDFC Mutual Fund’s Astounding Stock Selection

In the dynamic world of stock markets, understanding the investment strategies of leading mutual funds can provide invaluable insights for individual investors. HDFC Mutual Fund, a prominent player in the Indian asset management landscape, is known for its meticulous research and long-term vision. But what exactly drives their stock picks, especially when it comes to a significant allocation in Public Sector Undertakings (PSUs)? This article delves deep into the top 8 stocks currently held by HDFC Mutual Fund, offering an astute analysis of each, and exploring the reasons behind their astounding choices.

The Indian economy is on a path of robust growth, and PSUs often play a pivotal role in this journey, particularly in core sectors like infrastructure, energy, and finance. Their inherent stability, government backing, and often significant market share make them attractive propositions for institutional investors like HDFC Mutual Fund. By examining these 8 stocks, we aim to provide a comprehensive understanding of their potential and the underlying rationale for their inclusion in a top-tier mutual fund’s portfolio.

The Power of PSU Holdings in an HDFC Mutual Fund Portfolio

HDFC Mutual Fund‘s significant exposure to PSUs reflects a calculated strategy. Public Sector Undertakings are entities where the government holds a majority stake. This ownership often translates to a certain level of stability and a backing that can be crucial during economic fluctuations. Moreover, many PSUs are deeply embedded in the foundational sectors of the Indian economy, benefiting directly from government initiatives and infrastructure development.

Why PSUs? A Strategic Imperative

PSUs are not merely government-owned entities; they are often the backbone of vital sectors, contributing significantly to India’s economic stability by providing essential services and products, especially in areas like energy, transportation, and infrastructure. They also create substantial employment opportunities, helping to reduce unemployment and support livelihoods across various regions. For a fund like HDFC Mutual Fund, investing in PSUs can offer:

- Stability and Resilience: Government backing often provides a safety net, making these stocks relatively more resilient during market downturns.

- Alignment with National Growth: As India invests heavily in infrastructure and energy, PSUs are direct beneficiaries, positioning them for long-term growth.

- Dividend Potential: Many PSUs have a history of consistent dividend payouts, offering a steady income stream to investors.

- Value Play: Historically, PSUs have sometimes traded at lower valuations compared to their private sector counterparts, offering potential for value appreciation as their performance improves and market perception shifts.

The Top 8 Astounding Stocks in HDFC Mutual Fund’s Portfolio

Let’s dissect the top 8 stocks held by HDFC Mutual Fund, exploring their recent performance, sectoral significance, and future outlook. The prices mentioned are approximate as of June 25, 2025.

1. BHEL (Bharat Heavy Electricals Limited) – ₹253.25

BHEL is a leading engineering and manufacturing company in India, operating in the power and infrastructure sectors. It’s a critical player in India’s energy landscape, involved in everything from power generation equipment to renewable energy solutions.

BHEL’s Market Position and Future Prospects

BHEL’s significance lies in its role in India’s power sector. With the nation’s increasing energy demands and ambitious renewable energy targets, BHEL is well-positioned for future growth. The company has seen increased investor confidence, driven by defense demand and internal developments, and has delivered impressive long-term returns, with the stock surging 210% over the past 2 years and a remarkable 593% return over the last 5 years. As of June 25, 2025, BHEL’s share price climbed 1.63% to ₹264.15 on the BSE, marking their fourth straight day of gains, even as geopolitical tensions eased. This indicates strong buying support and optimism around the company’s future.

Key Drivers for BHEL

- Government Focus on Infrastructure: Increased government spending on power and infrastructure projects directly benefits BHEL.

- Energy Transition: BHEL’s foray into renewable energy segments like solar and hydro power aligns with India’s clean energy goals.

- Order Book Growth: A robust order book is crucial for BHEL’s sustained revenue and profitability. The company continues to secure significant orders, reflecting its dominant position.

2. HUDCO (Housing and Urban Development Corporation Limited) – ₹231.70

HUDCO is a public sector undertaking that provides financial assistance for housing and urban development projects in India. Its role is crucial in supporting the government’s affordable housing initiatives and urban infrastructure development.

HUDCO’s Role in India’s Development

HUDCO plays a vital role in realizing the vision of “Housing for All.” Its focus on providing long-term finance for housing and urban infrastructure makes it an integral part of India’s development agenda. For Q4 FY2025, HUDCO reported a net profit jump of 3.94% year-on-year to ₹727.74 crore, indicating stable performance.

Growth Catalysts for HUDCO

- Affordable Housing Push: Government schemes and increased budgetary allocations for affordable housing directly boost HUDCO’s business.

- Urban Infrastructure Development: Rapid urbanization necessitates significant investment in urban infrastructure, a key area for HUDCO.

- Partnerships with State Governments: HUDCO’s collaborations with various state governments for project financing ensure a steady pipeline of opportunities.

3. NLC India (Neyveli Lignite Corporation India Limited) – ₹227.49

NLC India is a Navratna Public Sector Enterprise involved in lignite mining and power generation. It is a significant contributor to India’s energy security, primarily through thermal power generation.

NLC India’s Energy Contribution

NLC India is a cornerstone of India’s energy sector, providing consistent and affordable power. Its strategic importance in the energy matrix makes it a valuable asset. The company delivered an impressive Return on Equity (ROE) of 14.0% in the year ending March 31, 2025, outperforming its 5-year average of 10.52%. Its annual revenue growth of 21.1% also outstripped its 3-year CAGR of 10.31%, signaling strong financial health.

Factors Driving NLC India’s Performance

- Power Demand Growth: India’s ever-increasing power demand ensures a stable market for NLC India’s generated electricity.

- Fuel Security: Control over lignite mines provides NLC India with a secure and cost-effective fuel source.

- Diversification into Renewables: While primarily a lignite-based power producer, NLC India is gradually diversifying into solar and wind power, aligning with the country’s renewable energy goals.

4. Union Bank (Union Bank of India) – ₹143.24

Union Bank of India is one of the largest public sector banks in India, offering a wide range of banking and financial services. Its vast network and customer base make it a key player in the Indian banking sector.

Union Bank’s Financial Resilience

Public sector banks like Union Bank have undergone significant reforms in recent years, focusing on improving asset quality and operational efficiency. Union Bank of India’s Q4 FY2025 results show a net profit of ₹5,011.22 crore, with its Net Interest Margin (NIM) at 3.50%. This demonstrates improving profitability and asset quality.

Key Opportunities for Union Bank

- Credit Growth: As the Indian economy expands, demand for credit from various sectors drives loan book growth for banks.

- Digitalization: Investing in digital banking platforms enhances customer experience and reduces operational costs.

- Asset Quality Improvement: Continued efforts to reduce Non-Performing Assets (NPAs) will further strengthen its balance sheet. The Gross Non-Performing Assets (GNPA) ratio improved to 3.95% as of March 2025, compared to 5.73% a year ago, reflecting a healthy trend.

5. IRFC (Indian Railway Finance Corporation Limited) – ₹136.54

IRFC is the dedicated financing arm of the Indian Railways, responsible for raising financial resources for the development and expansion of the Indian railway network.

IRFC’s Critical Role in Indian Railways

IRFC’s importance cannot be overstated in India’s rapidly modernizing railway system. As the government continues to invest heavily in railway infrastructure, from high-speed rail to freight corridors, IRFC plays a central role in facilitating these projects. IRFC’s net profit for Q4 FY2025 fell slightly by 2.06% year-on-year to ₹1,681.87 crore, but on a quarterly basis, profits jumped 3.14%. The company is actively diversifying its funding strategies and targeting new projects to enhance margins.

Growth Drivers for IRFC

- Railway Modernization: Massive investments planned for upgrading and expanding railway infrastructure directly benefit IRFC.

- Dedicated Freight Corridors: These projects require substantial funding, which IRFC helps secure.

- Strong Government Support: Being the sole financing arm of Indian Railways provides IRFC with strong government backing and a steady business pipeline.

6. PNB (Punjab National Bank) – ₹103.85

Punjab National Bank is another major public sector bank in India, with a significant presence across the country. Like other PSBs, PNB is focusing on strengthening its financial health and enhancing its service offerings.

PNB’s Path to Recovery and Growth

PNB has shown significant strides in improving its financial performance and asset quality. For Q4 FY2025, PNB recorded a nearly 52% rise in its standalone net profit to ₹4,567 crore, compared to ₹3,010.27 crore in the same period last year. Its net interest income (NII) saw a 3.8% rise. The Gross Non-Performing Assets (GNPA) ratio improved to 3.95% as of March 2025, down from 5.73% a year ago.

Factors Influencing PNB

- Robust Retail Credit Demand: The increasing demand for home loans, personal loans, and vehicle loans contributes to PNB’s retail portfolio growth.

- Corporate Credit Revival: As the economy picks up, corporate credit demand is expected to rebound, benefiting PNB.

- Technology Adoption: Investing in robust digital platforms is crucial for PNB to remain competitive and attract new customers.

7. SJVN (Sutlej Jal Vidyut Nigam Limited) – ₹98

SJVN is a leading public sector undertaking primarily engaged in hydro-power generation. It has diversified into other forms of renewable energy, including solar and wind power.

SJVN’s Contribution to Green Energy

SJVN is at the forefront of India’s push for renewable energy, particularly hydro and solar power. Its projects contribute to cleaner energy sources and sustainable development. While SJVN reported a net loss of ₹127.6 crore in Q4 FY2025, its gross profit margin remains high at 96.32%. The company’s expansion into new renewable energy projects is a key focus.

Growth Prospects for SJVN

- Renewable Energy Targets: India’s ambitious targets for increasing renewable energy capacity create significant opportunities for SJVN.

- Hydro Power Potential: India has vast untapped hydro-power potential, and SJVN is well-positioned to capitalize on this.

- Project Pipeline: A strong pipeline of ongoing and upcoming hydro and solar projects ensures future revenue streams.

8. Central Bank (Central Bank of India) – ₹38.04

Central Bank of India is another public sector bank working towards financial consolidation and growth. It serves a diverse customer base across various segments.

Central Bank’s Turnaround Story

Central Bank of India has been on a journey of recovery, focusing on improving its asset quality and profitability. For FY2025, Central Bank of India reported a net profit margin of 11.64%, with a basic EPS of ₹4.53. The bank’s gross NPA improved to 3.18% in Q4 FY2025, down from 4.50% a year ago, showcasing a remarkable improvement in asset quality.

Potential for Central Bank

- Resolution of NPAs: Successful resolution of non-performing assets will free up capital and improve profitability.

- Digital Transformation: Embracing digital technologies for banking operations can enhance efficiency and customer reach.

- Government Support for PSBs: The government’s continued focus on strengthening public sector banks provides a supportive environment for Central Bank of India.

Investing with HDFC Mutual Fund: A Smart Strategy

Investing in mutual funds, especially those managed by reputable institutions like HDFC Mutual Fund, offers several compelling advantages over direct stock investing. While the allure of picking individual winning stocks is strong, mutual funds provide diversification, professional management, and convenience, making them an excellent choice for both novice and experienced investors.

The Undeniable Advantages of Mutual Funds

- Professional Management: Fund managers at HDFC Mutual Fund are seasoned experts who continuously research and monitor market trends, making informed decisions on behalf of investors. This saves individuals the time and effort required for in-depth stock analysis.

- Diversification: Mutual funds inherently offer diversification by investing in a basket of securities across various sectors and market capitalizations. This significantly reduces the risk associated with investing in a single stock. Imagine if one of the 8 stocks above faced a significant downturn – the impact on a diversified mutual fund would be far less severe than if you held that single stock directly.

- Affordability: You can start investing in mutual funds with relatively small amounts through Systematic Investment Plans (SIPs), allowing you to build wealth over time without needing a large lump sum.

- Liquidity: Most mutual funds offer good liquidity, allowing you to buy or sell units easily at the prevailing Net Asset Value (NAV).

- Transparency and Regulation: Mutual funds in India are regulated by SEBI (Securities and Exchange Board of India), ensuring transparency and protecting investor interests.

Why HDFC Mutual Fund Stands Out

HDFC Mutual Fund has a long-standing track record of delivering consistent returns and adhering to robust investment philosophies. Their ability to identify and invest in promising companies, including the PSUs highlighted in this article, showcases their expertise and commitment to wealth creation for their investors. Their balanced approach to risk and return, coupled with in-depth research, makes them a trustworthy choice for your investment journey.

Conclusion: Empowering Your Investment Journey with HDFC Mutual Fund

The top 8 stocks owned by HDFC Mutual Fund, predominantly PSUs, represent a strategic and potentially rewarding investment approach. Companies like BHEL, HUDCO, NLC India, Union Bank, IRFC, PNB, SJVN, and Central Bank are not just financial instruments; they are integral components of India’s growth story. Their strong market positions, government backing, and alignment with national development priorities make them compelling choices for a mutual fund seeking long-term value.

By understanding the rationale behind HDFC Mutual Fund‘s selections, individual investors can gain valuable insights into the market. While direct stock investing has its merits, the diversification, professional management, and convenience offered by mutual funds like those from HDFC Mutual Fund make them an exceptionally powerful tool for wealth creation.

Remember, investing in the stock market involves inherent risks. It is always advisable to conduct your own research and consult with a qualified financial advisor before making any investment decisions. However, by leveraging the expertise of institutions like HDFC Mutual Fund, you can position yourself for a more secure and prosperous financial future.

Don’t miss out on the opportunity to grow your wealth with expert-managed funds. Explore the offerings of HDFC Mutual Fund today and take a smart step towards achieving your financial goals!

Frequently Asked Questions (FAQs)

Q1: What is a Public Sector Undertaking (PSU)?

A Public Sector Undertaking (PSU) in India is a company in which the majority stake (51% or more) is held by the Central Government or a State Government, or by multiple State Governments. These companies operate in various sectors, including banking, finance, energy, infrastructure, and manufacturing.

Q2: Why does HDFC Mutual Fund invest in PSUs?

HDFC Mutual Fund invests in PSUs for several strategic reasons, including their inherent stability due to government backing, their crucial role in India’s economic growth sectors (like infrastructure and energy), and their potential for value appreciation and consistent dividend payouts.

Q3: Are PSUs riskier than private sector stocks?

Not necessarily. While some PSUs might have faced challenges in the past, many have undergone significant reforms and are now demonstrating strong financial performance and governance. Their government backing can also provide a level of stability not always present in private sector companies. However, like all investments, PSUs carry market risks.

Q4: How does diversification in a mutual fund help mitigate risk?

Diversification involves spreading investments across various assets, industries, and geographies. In a mutual fund, this means the fund manager invests in many different stocks, reducing the impact if any single stock or sector performs poorly. This lessens overall portfolio risk compared to investing heavily in just one or a few individual stocks.

Q5: What is the benefit of investing in a mutual fund via a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly (e.g., monthly) in a mutual fund. The key benefits include rupee cost averaging (where you buy more units when prices are low and fewer when high, averaging out your purchase cost), financial discipline, and the power of compounding over the long term.

Q6: How can I start investing in HDFC Mutual Fund?

You can start investing in HDFC Mutual Fund through various channels, including their official website, authorized distributors, financial advisors, or online investment platforms. You will typically need to complete KYC (Know Your Customer) formalities before investing.