Ready to learn how to analyze stocks for beginners? This guide breaks down 10 powerful tips, from fundamental analysis to reading charts. Start investing smarter.

How to Analyze Stocks: 10 Powerful Tips for Beginners

Diving into the stock market can feel like trying to navigate a vast ocean without a compass. With thousands of companies to choose from and a constant barrage of financial news, it’s easy to feel overwhelmed. But what if you had a clear, step-by-step roadmap? This guide on how to analyze stocks for beginners is exactly that. You don’t need a finance degree to make informed investment decisions. You just need the right knowledge and a disciplined approach.

Learning to analyze stocks is the single most important skill that separates successful investors from speculators. It’s the difference between buying a company and just buying a ticker symbol. According to a 2023 Gallup poll, a record-high 61% of Americans own stocks, making this skill more relevant than ever.

Ready to build your confidence and start your journey? Let’s explore the 10 powerful tips that will teach you how to analyze stocks effectively.

Understanding the Two Pillars: Fundamental vs. Technical Analysis

Before we dive into the tips, it’s crucial to understand the two primary schools of thought in stock analysis. Think of them as two different lenses to view the same company.

Fundamental Analysis for Beginners: The ‘Why’

Fundamental analysis involves looking at a company’s financial health and underlying business to determine its intrinsic value. It answers the question, “Why should I buy this company?” You’ll look at things like:

- Revenue and profits

- Debt levels

- Cash flow

- The industry it operates in

- Its competitive advantages

The goal is to find companies that are trading for less than they are truly worth. Legendary investor Warren Buffett is a master of fundamental analysis.

Technical Analysis for Beginners: The ‘When’

Technical analysis, on the other hand, isn’t concerned with the company’s intrinsic value. Instead, it focuses on stock price movements and trading volumes. It uses charts and statistical indicators to predict future price trends, answering the question, “When is a good time to buy (or sell) this stock?”

While many long-term investors lean on fundamentals, understanding basic technicals can help you with entry and exit points.

For beginners, a blend of both is often the most powerful approach. Now, let’s get into the actionable tips.

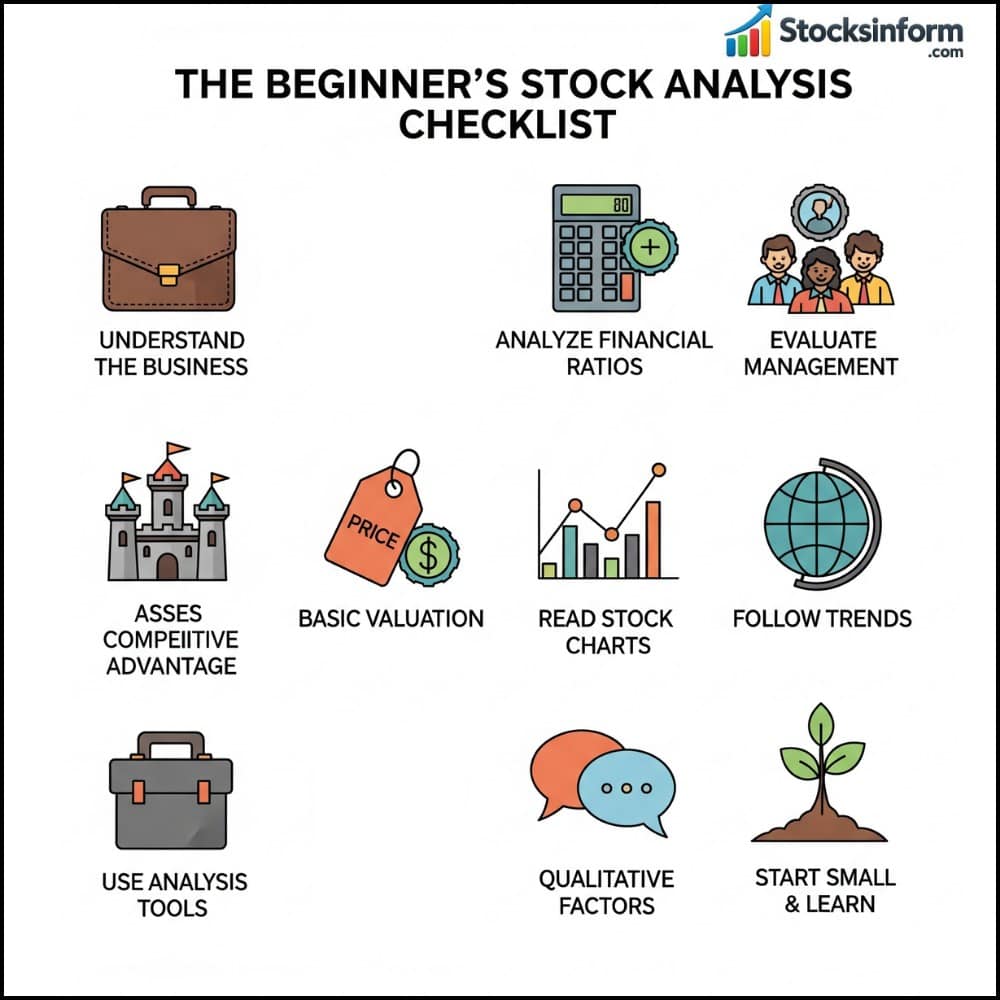

10 Powerful Tips on How to Analyze Stocks for Beginners

Here is a practical, step-by-step framework to guide your research process.

1. Understand the Business Model (What Do They Actually Do?)

This is the most critical and often overlooked step in how to research stocks. Before you look at a single number, ask yourself: “Do I understand how this company makes money?”

If you can’t explain the business to a friend in two minutes, you should probably stay away.

- What products or services do they sell?

- Who are their customers?

- How do they generate revenue? (e.g., subscriptions, one-time sales, advertising)

Example: Apple Inc. (AAPL). Most people understand its business. It designs and sells consumer electronics like the iPhone and Mac, software like iOS, and services like the App Store and Apple Music. This clarity is a great starting point.

2. Analyze the Company’s Financial Health (Financial Ratio Analysis)

Once you understand the business, it’s time to check its vital signs. You can find all this information in a company’s quarterly (10-Q) and annual (10-K) reports, which are publicly available on the SEC’s EDGAR database. Don’t worry, you don’t need to read every page. Start by looking at key financial ratios.

- Earnings Per Share (EPS): How much profit the company makes per share of its stock. Look for consistent EPS growth.

- Price-to-Earnings (P/E) Ratio:

Stock Price / EPS. This helps you understand if a stock is overvalued or undervalued compared to its peers. A high P/E could mean high growth expectations, while a low P/E might signal a bargain. - Debt-to-Equity Ratio:

Total Debt / Shareholder Equity. This shows how much a company relies on debt to finance its operations. A ratio below 1.0 is generally considered safe. - Return on Equity (ROE):

Net Income / Shareholder Equity. This measures how efficiently the company is generating profit from its investors’ money. Consistently high ROE (above 15%) is a great sign.

3. Evaluate the Management Team

A company is only as good as the people running it. Look for a management team that is experienced, transparent, and has a clear vision for the future.

- Read the “Letter to Shareholders” in the annual report. Does the CEO sound honest about challenges and clear about opportunities?

- Check sites like Glassdoor for employee reviews. Happy employees often lead to better company performance.

- Look at insider ownership. Do the executives own a significant amount of company stock? This means they have “skin in the game.”

4. Assess the Competitive Landscape (The Moat)

Warren Buffett popularized the idea of an “economic moat”—a durable competitive advantage that protects a company from competitors, much like a moat protects a castle. Learning how to pick stocks often comes down to finding companies with wide moats.

Types of moats include:

- Brand Recognition: Think of Coca-Cola or Nike.

- Patents & Intellectual Property: Pharmaceutical and tech companies rely on these.

- Network Effect: The more people use it, the more valuable it becomes (e.g., Facebook, Amazon).

- Switching Costs: It’s a hassle for customers to switch to a competitor (e.g., your bank or Microsoft Windows).

5. Learn Basic Stock Valuation Methods

How do you know if a stock’s price is fair? This is where valuation comes in. While complex models exist, beginners can start with simple methods.

One common approach is to compare a company’s P/E ratio to its competitors in the same industry. If Company A has a P/E of 15 and the industry average is 25, it might be undervalued, warranting a closer look.

This step is a core part of stock valuation methods and helps prevent you from overpaying for a stock, which is a common mistake.

6. Start Reading Stock Charts for Beginners

While fundamental analysis is about the ‘why’, reading stock charts for beginners helps with the ‘when’. You don’t need to be an expert, but understanding a few basics is helpful.

- Support and Resistance: Support is a price level where a stock tends to stop falling, and resistance is a level where it tends to stop rising.

- Moving Averages: The 50-day and 200-day moving averages are popular indicators. When the 50-day crosses above the 200-day (a “golden cross”), it’s often seen as a bullish signal.

7. Follow Industry and Economic Trends

No company exists in a vacuum. It’s affected by the health of its industry and the broader economy.

- Is the industry growing or shrinking? (e.g., Renewable energy vs. print newspapers)

- How do interest rates affect the company? (High rates can hurt companies with a lot of debt).

- Are there new regulations that could impact the business?

Staying informed by reading reputable financial news from sources like Bloomberg or Reuters is essential.

8. Utilize the Best Stock Analysis Tools

You don’t have to do all the math yourself. There are fantastic tools available, many of them free, that can help you analyze stocks.

- Yahoo! Finance: Great for quick overviews, key statistics, and financial statements.

- Seeking Alpha: Offers crowd-sourced analysis and opinions from various investors.

- Your Brokerage’s Platform: Most brokers like Fidelity or Charles Schwab provide powerful research tools for their clients.

These tools make stock analysis for beginners much more accessible.

9. Don’t Ignore Qualitative Factors

Numbers tell part of the story, but not all of it. Qualitative factors are the intangible aspects that can have a huge impact.

As the famous fund manager Peter Lynch said, “Know what you own, and know why you own it.” This goes beyond numbers.

- Company Culture: Is it innovative and ethical?

- Customer Satisfaction: Do people love their products?

- Brand Strength: Does the company have a loyal following?

These factors contribute to a company’s long-term resilience and success.

10. Start Small and Keep Learning

Your first analysis won’t be perfect, and that’s okay. The goal is to get started. Analyze a company you know and use. Maybe it’s the company that makes your phone, your favorite coffee, or your running shoes.

Start with a small amount of capital you’re comfortable risking. The most important thing is to treat every investment as a learning experience. Document why you bought a stock. Later, review your decision—whether you made or lost money—to refine your process.

Conclusion: Your Journey to Confident Investing Starts Now

Learning how to analyze stocks for beginners is a journey, not a destination. It’s about building a repeatable process that helps you make logical, evidence-based decisions instead of emotional ones.

By combining an understanding of the business (fundamental analysis) with an eye on market trends (technical analysis), you can dramatically improve your chances of success. Start with Tip #1 today: pick one company you use every day and explain how it makes money. That first step is the most powerful one you can take.

Frequently Asked Questions (FAQ)

Q1: What is the first thing to do when analyzing a stock?

The very first step is to understand the business model. Before looking at any financials or charts, you must be able to clearly explain what the company does and how it makes money.

Q2: Can I learn stock analysis on my own?

Absolutely. With the wealth of information available online through company filings (SEC EDGAR), financial news sites, and educational resources, anyone can learn the principles of stock analysis. It requires curiosity, discipline, and a willingness to learn continuously.

Q3: How long does it take to analyze a stock properly?

For a beginner, a thorough first analysis of a company might take a few hours spread over several days. As you become more experienced and familiar with an industry, you’ll be able to analyze companies more efficiently. The key is to be thorough, not fast.

Q4: What is more important for a beginner: fundamental or technical analysis?

For long-term investors, fundamental analysis is more important. It helps you find great companies worth owning for years. Technical analysis is a useful secondary tool to help time your purchases. A beginner should focus on mastering the basics of fundamental analysis first.