Know What Are Shares In Stock Market? This comprehensive guide will tell you share market basics, types of shares, how to buy and sell them, and stock market timings in India.

1. Introduction: What is the game of share market?

Have you ever thought how big companies like Reliance, Tata or Infosys run such big operations and raise funds? The big answer to this is share market! When we talk about what are shares in stock market, we are basically talking about small pieces of the company. Every share represents partial ownership in a company. Just like you buy a slice of pizza, similarly by buying shares you become the owner of a small part of the company.

Thousands of people in India invest in stock market every day, with the hope of increasing their money. But, many people enter without having a basic understanding of it and suffer losses. This blog post will give you complete information about shares and stock market, in Hinglish, so that you can take an informed decision. So let’s start this exciting journey!

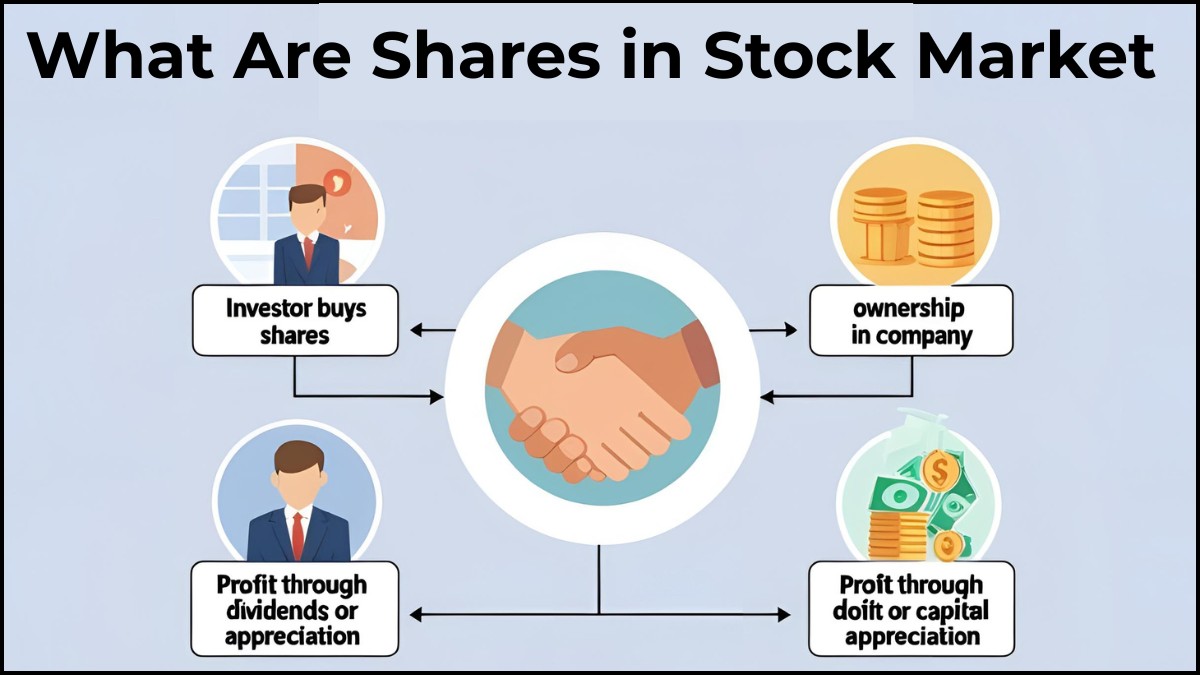

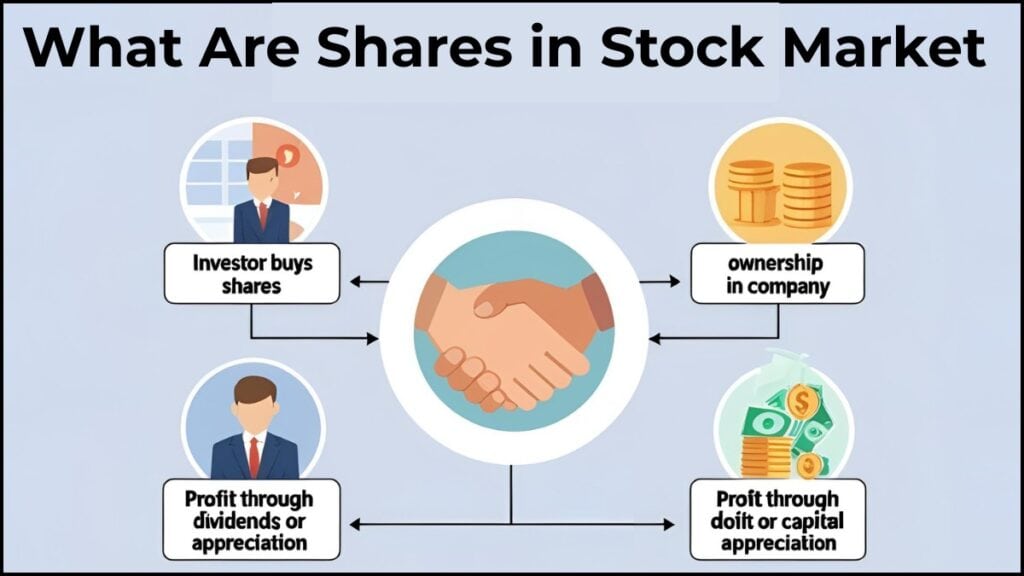

2. What are Shares in Stock Market: The Core Concept

Basically, what are shares in stock market? Shares or stocks are a financial instrument that denotes a unit of ownership in a company. When a company needs capital to expand its business, start new projects or repay debts, it issues shares to the public. People who buy these shares become shareholders of the company and get a small share in the company’s profits (in the form of dividends) and assets.

Shareholders often also get voting rights, which allows them to take part in important company decisions. The value of shares fluctuates with the performance of the company, market sentiment and broader economic conditions. This means the value of your shares can increase (capital appreciation) or decrease.

3. How Many Shares in Share Market Can I Buy?

There is no specific limit on how many shares you can buy. It depends on your investment capital and the share price of the company whose shares you want to buy.

Minimum Investment: You can buy even a single share. Some companies have very cheap shares (penny stocks), while some have shares worth thousands or lakhs.

Lot Size: In the derivatives market (like Futures & Options), shares are traded in “lot size”. This means that you have to buy a minimum number of shares at once. But in the equity market, you can buy single shares as well.

It is important that you invest according to your risk appetite and financial goals. Always do your research and create a diversified portfolio.

4. Who are Investors in Stock Market?

In the stock market, investors are of different categories, each of which has its own investment objective and risk profile:

1. Retail Investors:

These are individual investors like us who invest their personal savings. Their investment amount is relatively low.

2. Institutional Investors:

These are large organizations such as mutual funds, pension funds, insurance companies, and banks. They invest in large amounts and can have a significant impact on the market.

3. High Net Worth Individuals (HNIs):

These are individuals who have a lot of liquid wealth and invest large amounts.

4. Foreign Institutional Investors (FIIs) / Foreign Portfolio Investors (FPIs):

These are foreign companies and funds that invest in the Indian stock market. Their investments have a big impact on market sentiment.

5. Promoters:

These are people or entities who started the company and have the biggest stake in the company.

Every investor has a different motive – some want long-term growth, some want regular income (dividends) and some focus on short-term profits (trading).

5. How Many Types of Shares in Stock Market Are There?

There are many types of shares in the stock market, but primarily there are two main categories:

1. Equity Shares (Ordinary Shares):

- These are the most common types of shares.

- Equity shareholders are the true owners of the company.

- They get voting rights, which allows them to participate in annual general meetings (AGMs) and vote on important decisions of the company.

- They get dividends, but these are not fixed and depend on the profits of the company.

- When a company is liquidated, equity shareholders get money last, after preference shareholders and creditors.

- They have the highest potential for capital appreciation.

2. Preference Shares:

- They get preferential rights over equity shares.

- They get fixed dividend rate, which has to be paid whether the company has profits or not (before equity shareholders).

- When the company is liquidated, preference shareholders get money before equity shareholders.

- Generally, they do not get voting rights.

- They fall between debt and equity.

- Apart from these, there are some special types of shares as well such as:

3. Bonus Shares:

These are given to existing shareholders for free. When the company has significant reserves, it converts them into share capital.

4. Rights Shares:

The company gives existing shareholders the option to buy new shares, often at a price lower than the market price.

5. Sweat Equity Shares:

These are given to the company’s employees or directors for their special contributions.

6. Where to Buy Shares in Stock Market in India?

To buy shares in India, you have to follow some steps:

- Open a Demat Account: This is like a digital locker where your shares are stored in electronic form.

- Open a Trading Account: This account allows you to buy and sell shares. Often Demat and Trading accounts are opened together with a brokerage firm.

- Link a Bank Account: Your bank account should be linked to Demat and Trading account to transfer funds.

- Choose a Stockbroker: There are many registered stockbrokers in India like Zerodha, Upstox, Groww, ICICI Direct, HDFC Securities. Choose a broker according to your needs (check brokerage charges, platform features, research support, etc.).

Once your accounts are ready, you can buy and sell shares through the broker’s trading platform (website or app).

7. When to Buy Shares in Stock Market: The Art of Timing

It’s hard to catch “perfect timing” in the stock market, but there are a few principles that can help:

1. Long-Term Investment:

If you’re a long-term investor (1-5 years or more), short-term market fluctuations don’t matter as much. You can use the “dollar-cost averaging” technique, where you invest fixed amounts at regular intervals, irrespective of share price.

2. Fundamental Analysis:

Analyze the company’s financial health (revenue, profit, debt), management quality, industry outlook, and competitive landscape. When a fundamentally strong company’s stock is at fair value or undervalued, it may be a good idea to buy.

3. Technical Analysis:

Some traders decide entry and exit points by analyzing historical price patterns and trading volumes.

4. Market Corrections:

When the market falls (market correction), then there is an opportunity to buy quality stocks at a discount. This is the “Buy the Dip” strategy.

5. Avoid Herd Mentality:

When everyone is chasing the same stock, be cautious. Do research and make your own decisions.

A famous investor, Warren Buffett, said, “Be fearful when others are greedy and greedy when others are fearful.” This quote highlights the importance of timing.

8. When Share Market Start in India: Trading Hours

Indian stock market, mainly NSE (National Stock Exchange) and BSE (Bombay Stock Exchange), operate at specific timings:

- Pre-Open Session: 9:00 AM to 9:15 AM. During this time orders can be placed, modified, or cancelled, and opening prices are determined.

- Normal Trading Session: 9:15 AM to 3:30 PM, Monday to Friday. During this time you can buy and sell shares.

- Post-Market Session: 3:40 PM to 4:00 PM. During this time some specific types of orders can be placed.

The market remains closed on weekends (Saturday, Sunday) and public holidays. A list of stock market holidays is available on the exchanges’ website.

9. How Shares are Listed in Stock Exchange?

Shares of any company have to be “listed” to be traded on the stock exchange. This process is called Initial Public Offering (IPO).

- Preparation:

The company prepares its financial statements, business plans, and future prospects. It engages Merchant Bankers who help in the IPO process.

- SEBI Approval:

The company has to get approval from the Securities and Exchange Board of India (SEBI). SEBI sets strict guidelines for investor protection. The company has to submit a Draft Red Herring Prospectus (DRHP), which contains detailed information.

- Exchange Application:

The company applies for listing on stock exchanges like NSE and/or BSE. Exchanges have their own listing criteria like minimum paid-up capital and track record of the company. For example, to list on NSE, the paid-up equity capital of the company should not be less than ₹10 crores and its equity capitalization should not be less than ₹25 crores.

- Roadshows & Marketing:

The company conducts roadshows and marketing activities to attract potential investors.

- IPO Launch:

The company offers shares to the public, which is called the primary market. Investors place bids.

- Allotment & Listing:

Shares are allotted to investors and then listed for trading on the stock exchange. After this, shares trade in the secondary market, where investors buy and sell shares from each other.

10. How Many Shares are Listed in Indian Stock Market?

The Indian stock market is one of the largest and vibrant markets in the world. As of early 2025, there are more than 5,200 companies listed on the Bombay Stock Exchange (BSE), while approximately 2,200 companies are listed on the National Stock Exchange (NSE). Some companies are listed on both exchanges. Overall, more than 5,500 unique companies are available for public trading in India.

This large number provides diverse investment opportunities to investors across various sectors such as banking, IT, healthcare, manufacturing, and FMCG. This allows you to diversify your portfolio well and manage risk.

Important Tips Before Investing

- Educate Yourself:

It is very important to have basic knowledge of the market before investing. Read books, read articles, and follow financial news. - Set Clear Goals:

Why are you investing? Do you want to create long-term wealth, save for retirement, or achieve a specific financial goal? By having clear goals, you can make the right investment strategy. - Start Small:

Do not invest large amounts in the beginning. Start with small amounts and understand the market. - Diversify:

Do not invest all your money in a single stock. Invest in different companies, sectors, and asset classes so that the risk is spread out. - Avoid Emotional Decisions:

Markets keep fluctuating. Take rational decisions without fear and greed. - Monitor regularly:

Monitor your investments on a regular basis, but avoid over-monitoring. - Consult an Expert:

If you are confused, consult a financial advisor.

Conclusion: The first step of your investment journey

I hope you now have a good understanding of what are shares in stock market and the concepts surrounding it. Shares are units of ownership in a company, which give investors a chance to earn capital appreciation and dividend income. India’s stock market is a vast playground where thousands of companies are listed, which provides opportunities for every kind of investor.

Remember, investing in stock market comes with risks. Only proper knowledge, research, and disciplined approach can make you a successful investor. Start your financial education journey today and become an informed investor!

Are you ready to invest in the stock market? Start your journey of financial growth by opening a Demat and Trading Account today!

Frequently Asked Questions (FAQ)

Q1: What are shares in stocks?

Answer:- Shares in stocks means a small portion of ownership in a company. When you buy shares, you become a partial owner of that company, which gives you a share in the company’s profits (dividends) and assets.

Q2: How many stocks is 1 share?

Answer:- “1 share” itself is one unit. “Stocks” is a broader term that refers to a collection of shares or general company ownership. So, you can say that 1 share is one unit of a stock.

Q3: What are the 4 types of shares?

Answer:- Generally, there are two main types of shares: Equity Shares and Preference Shares. But if we look in broad terms we can see some common categories:

Equity Shares: Common ownership with voting rights.

Preference Shares: Fixed dividends, no voting rights usually, preference in liquidation.

Bonus Shares: Free shares given to existing shareholders.

Rights Shares: New shares offered to existing shareholders at a discounted price.

Q4: Is 1 stock equal to 1 share?

Answer:- Yes, in commonly used terms, “1 stock” and “1 share” are used interchangeably when we are talking about the ownership unit of a particular company. But technically, “stock” is a general term for ownership capital, and “share” is the smallest unit of us capital.

Q5: Do shares earn money?

Answer:- Yes, money can be earned from shares in two ways:

Capital Appreciation: When you buy shares at a low price and their value increases, you make a profit on selling them.

Dividends: Some companies distribute a part of their profits among shareholders as dividends.